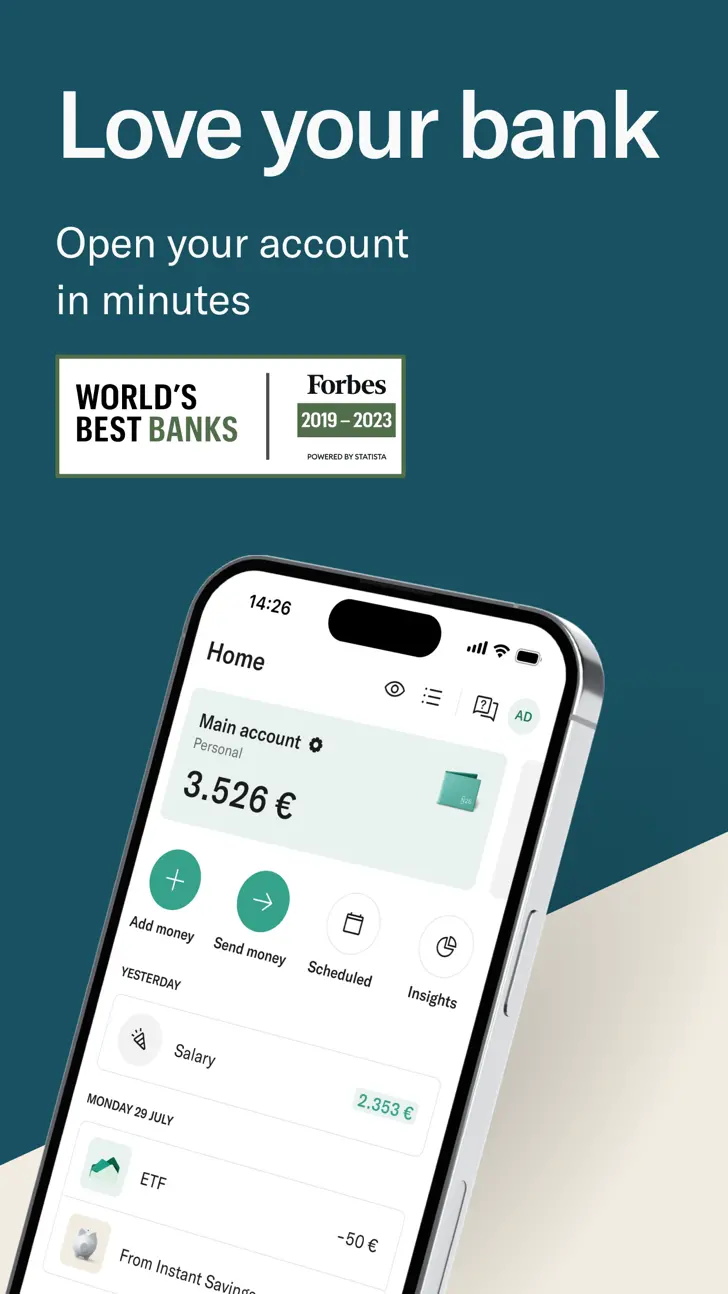

N26 Mobile Banking (de.no26.Number26): Bank anywhere, with your phone, Now with insurance integration...Read More > or Download Now >

N26 Mobile Banking for iPhone

Tech Specs

- • Latest Version: 3.127

- • Updated: April 23, 2024

- • Requires: iOS 15.0 and up

- • Developer: N26 GmbH

- • Age Rating: 4+

User Reviews

- • Rating Average

- 4.5 out of 5

- • Rating Users

- 8979

Download Count

- • Total Downloads

- 92

- • Current Version Downloads

- 0

You can download the the latest version of N26 Mobile Banking or explore its version history.

More About N26 Mobile Banking

- Open an account in 5 minutes directly from your phone. No long lines, no paperwork, no fuss.

- Enjoy banking with no hidden fees, no maintenance charges, no insufficient funds fees, no minimum account balance, and no foreign transaction fees when you shop using your N26 card internationally.

- Get your paycheck up to 2 days earlier with direct deposit.¹

- Achieve your short and long-term financial goals with Spaces. Set savings targets and transfer money with a single swipe.

- Instantly lock or unlock your card if it’s lost, set spending limits, reset your PIN, enable or disable international payments and more.

- Refer friends and get paid. Share your referral code with friends and family and receive a cash bonus deposited directly into your account when they sign up.

- Receive instant notifications on all account activity so you know what’s happening with your account in real-time.

- See exactly what you're spending your money on each month with automatically-categorized spending statistics.

- Enjoy 2 free ATM withdrawals per month — anytime, anywhere, any network.²

- Send and receive money from anyone who banks with N26 using MoneyBeam.

- Save money on subscriptions that fit into your lifestyle with N26 Perks.

Safety and security:

- Your N26 account is FDIC-insured, which means your money is protected up to - $250,000, so you can breathe and bank easier.

- Keep your account secure by logging in using fingerprint or face recognition.

- You’re protected from fraudulent purchases with Visa's Zero Liability policy.³

- Have a question? We’re here for you whenever you need us via our in-app support chat feature, by phone or email.

Disclosures:

¹ Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay the availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instructions.

² Fees still apply for international ATM withdrawals.

³ Visa’s Zero Liability Policy covers U.S.-issued cards only and does not apply to certain commercial card transactions or transactions not processed by Visa. You must notify your card issuer immediately of any unauthorized use. For specific restrictions, limitations and other details, please consult your issuer.

The N26 Account is offered by Axos Bank®, Member FDIC. N26 is a service provider of Axos Bank. All deposit accounts of the same ownership and/or vesting held at Axos Bank are combined and insured under the same FDIC Certificate 35546. All deposit accounts through Axos Bank brands are not separately insured by the FDIC from other deposit accounts held with the same ownership and/or vesting at Axos Bank. The N26 Visa® Debit Card is issued by Axos Bank pursuant to a license by Visa U.S.A. Inc. The N26 Visa Debit Card may be used everywhere Visa debit cards are accepted.

N26 Inc. does not currently offer or provide banking services on its own behalf or for its affiliates and is not a bank. N26 Inc. is wholly owned by N26 GmbH, which is also the parent company of N26 Bank GmbH. N26 Bank GmbH is a non-US bank, is not FDIC-insured, and does not offer or provide banking services in the United States or to US residents.

What's New in N26 Mobile Banking 3.127 >

Share finances the easy way with N26 joint accounts — now available in Austria, Spain, Belgium, Denmark, Estonia, Finland, Germany, Greece, Iceland, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Sweden, and Switzerland.

Simply head to the ‘Finances’ tab and invite a contact to open a joint account with you. Once it’s open, you’ll be able to link a card and set up recurring payments to pay for all your shared expenses.