mileME (com.mileme.mileME): mileME Automatic Mileage Log...Read More > or Download Now >

mileME for iPhone

Tech Specs

- • Latest Version: 2.24

- • Updated: August 2, 2020

- • Requires: iOS 11.0 and up

- • Developer: Mark Pfluger

- • Age Rating: 4+

User Reviews

- • Rating Average

- 4 out of 5

- • Rating Users

- 71

Download Count

- • Total Downloads

- 0

- • Current Version Downloads

- 0

You can download the the latest version of mileME or explore its version history.

More About mileME

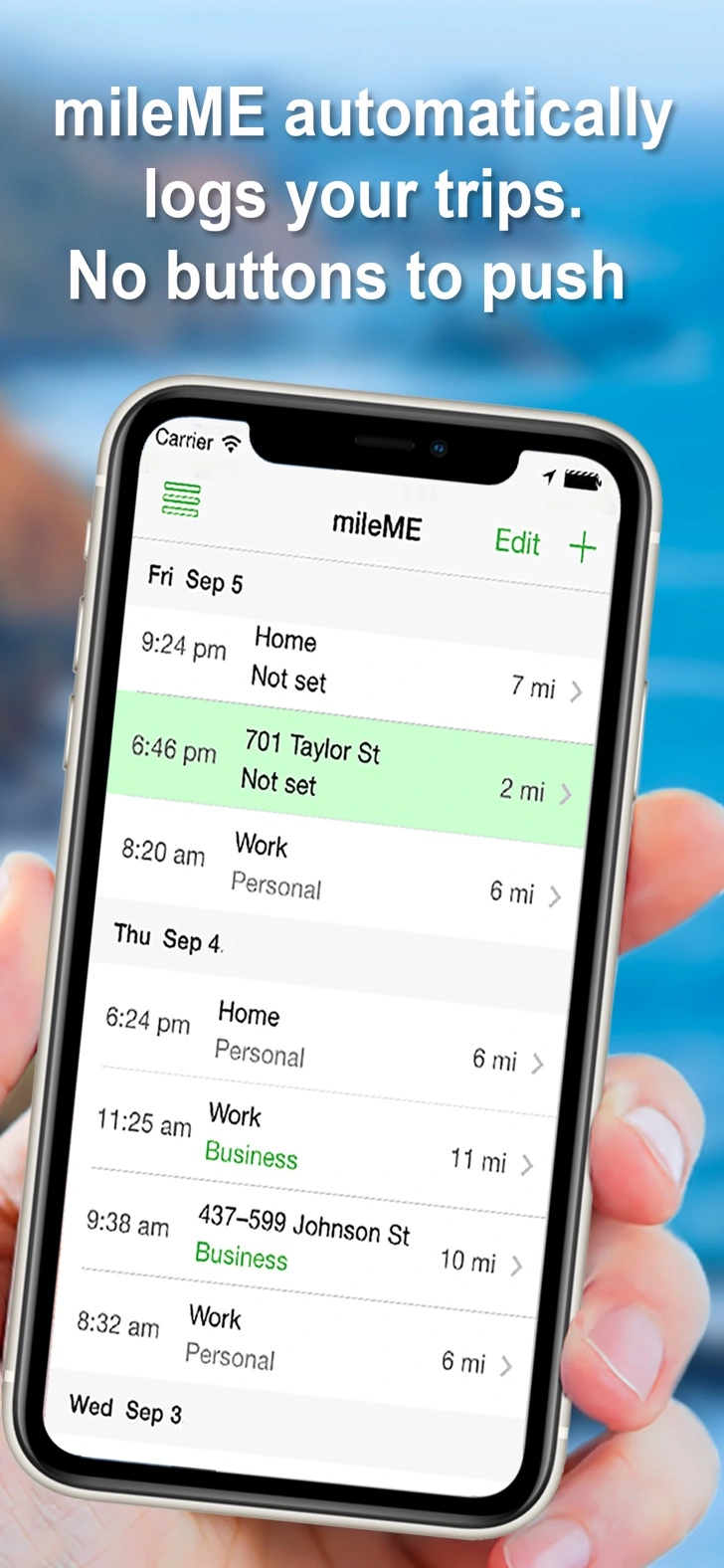

mileME uses location sensing to automatically log your trips and track your mileage. You don't have to start or stop it. Once a trip is recognized it is matched to your calendar to automatically set the purpose. mileME also learns from the information you enter. When you set a trip to a client as business, next time it will automatically show up as a business trip.

All your trips are synced to the cloud. You can generate reports in the app or on mileME.com. Sign up now and get the first 30 days for free. After that, the service costs $5.99/month or $59.99/year. This gets you unlimited reports and all your trips will be stored in the cloud for 4 years, in case you need the data.

Features:

√ Logs trips automatically

√ Categorize trips with a single swipe

√ Matches trips to calendar entries

√ Learns your business trips

√ Set your business hours

√ All your trips are synced to the cloud

√ Generate report in app or on mileME.com

√ Export to Excel, CSV and PDF

√ Supports kilometers and miles

√ Minimal battery usage

Benefit

How many months are you behind on your expense reports? How many business miles are you missing because you have no documentation?

mileME makes the process of logging your miles so simple you can get the benefit of the full tax deduction or reimbursement. At 54 cents per business mile driven that adds up to a lot of dollars in your pocket.

If you drive 12,000 miles a year for business, that means over $6,500 in reimbursements or tax deductions. After only 110 business miles mileME already pays for itself.

What our users are saying

“This app is utter genius. It does everything for you. I love it” -- Mallysparkley, UK

“Brilliant app. Works perfectly. Nothing else I have seen comes anywhere near this” -- Brook AV, UK

“I love this app! No more writing down my mileage or trying to remember to log my business activity.. The app does it all! The reports are thorough and my accountant gives me a discount because she doesn't have to add all my mileage up... The report has everything! GET THIS APP if you drive a lot for work!!!!” -- Amy, USA

Battery usage

mileME uses very little battery: on average 1-4% of your battery in 24 hours. Since continued use of GPS running in the background can dramatically decrease battery life, we developed technology to minimize the use of GPS.

Subscription

There are two paid plans available to get unlimited logging and reports. The monthly plan is $5.99 and the yearly plan $59.99. If you do not turn off auto-renewal, the plan will automatically renew for the next payment period. You can manage auto-renewal in your Account Settings.

Support

If you have any questions, you can send us an email directly from the mileME app. We're happy to help!

*** Get the best mileage tracker and logger now! ***

Terms of Service:

https://www.mileme.com/terms

Privacy Policy:

https://www.mileme.com/privacy

What's New in mileME 2.24 >

Optimized for all screen sizes and iOS versions